When a loan officer pulled a borrowers’ credit report, the Credit Bureaus—Experian, Equifax, and TransUnion—would turn around and sell your information to solicitors. Within hours, borrowers’ phone would light up with relentless calls and texts, often filled with misleading claims. For many, the flood of messages made their phones nearly unusable. And if they weren’t warned in advance, borrowers often assumed it was their loan officer who sold their information—not the credit bureaus.

This practice is called a Trigger Lead. It was a blatant violation of consumer privacy and, for years, was simply accepted as part of the homebuying process.

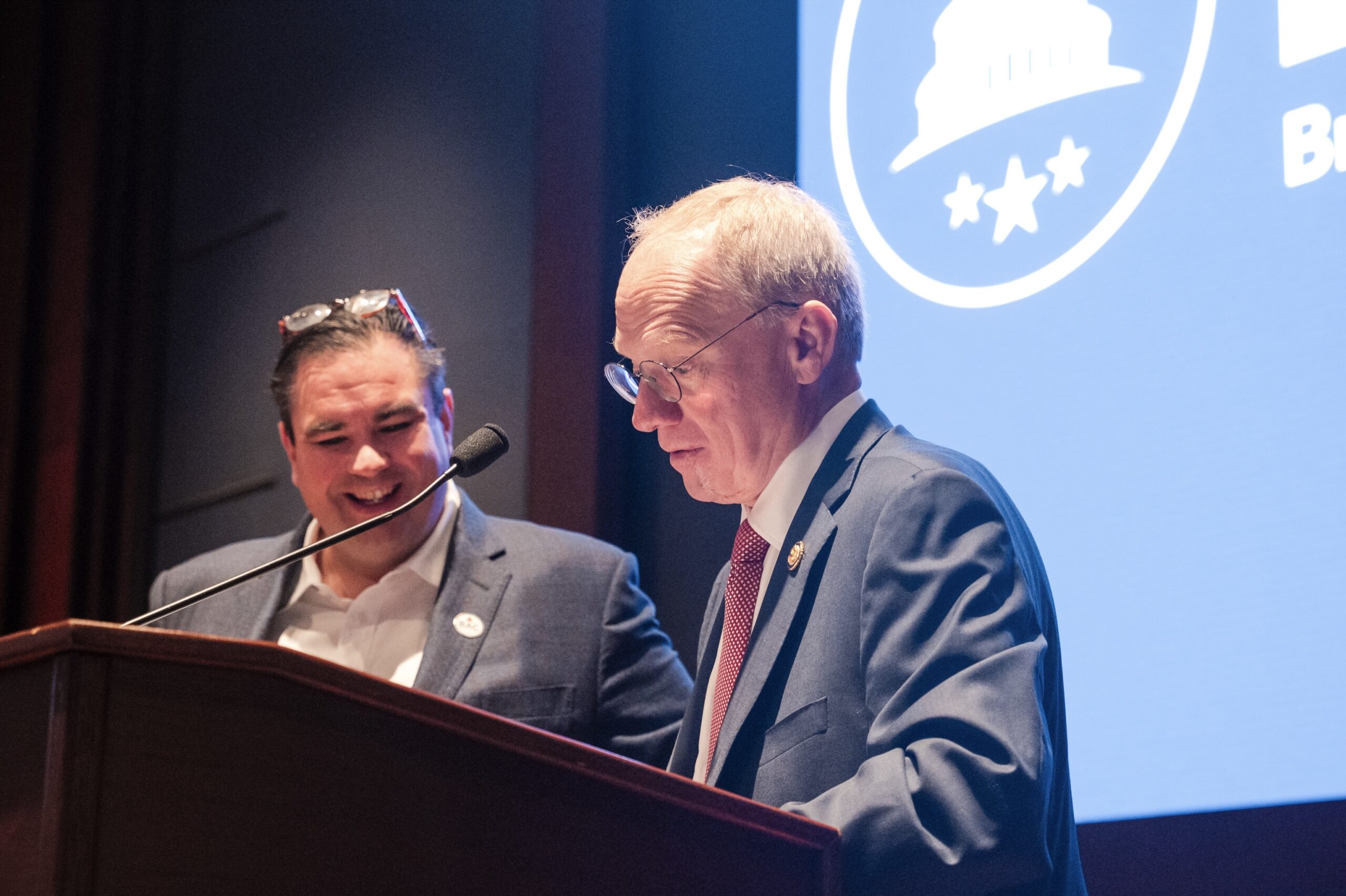

The Broker Action Coalition (BAC), under Brendan McKay’s leadership, made Trigger Lead Legislation its top priority. Brendan personally held more than 200 meetings on Capitol Hill, educating lawmakers and staff on the problem, showing how out of control the practice had become, and pressing for reform.

It wasn’t easy—three years of ups and downs, setbacks and momentum—but the effort ultimately paid off. The bill passed both the House and Senate unanimously and, at the time of writing, awaits the President’s signature to become law.

This victory was the result of a large-scale, industry-wide coalition effort—but Brendan was there every step of the way, from the bill’s introduction to the day it cleared Congress.